Budget 2025: Major Income Tax Relief Announced – No Tax Up to ₹12 Lakh

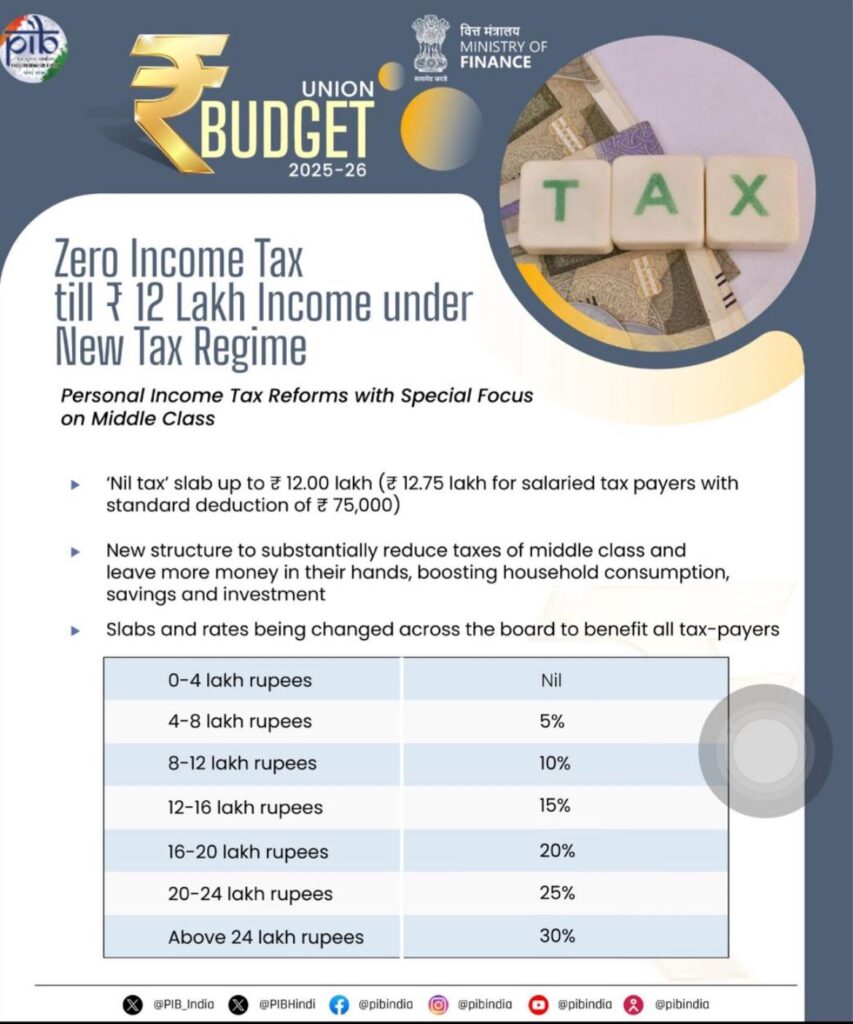

In a significant move aimed at easing the tax burden on the middle class, Union Finance Minister Nirmala Sitharaman announced a major revision in income tax slabs under the new tax regime during the Budget 2025 speech in the Lok Sabha. The highlight of the announcement is that individuals earning up to ₹12 lakh per year will now pay zero income tax, providing a major financial relief to millions of taxpayers.

Big Relief for Middle-Class Taxpayers

Speaking in Parliament, Sitharaman emphasized that the new tax structure aims to reduce the tax burden on the middle class, increase disposable income, and boost household consumption, savings, and investment.

Currently, taxpayers have two choices:

- Old Tax Regime – Offers exemptions and deductions, such as benefits on house rent, insurance, and investments (like PPF, ELSS, and home loans).

- New Tax Regime – Introduced in 2020, it provides lower tax rates but eliminates most exemptions and deductions.

The new tax regime was made the default option for business and professional income taxpayers from FY 2023-24. However, salaried individuals can still choose between the two regimes when filing their returns.

Revised Tax Slabs Under the New Tax Regime (Budget 2025)

| Annual Income (₹) | Tax Rate (%) |

|---|---|

| 0 to 3 lakh | Nil |

| 4 to 8 lakh | 5% |

| 8 to 12 lakh | 10% |

| 12 to 16 lakh | 15% |

| 16 to 20 lakh | 20% |

| 20 to 24 lakh | 24% |

| Above 24 lakh | 30% |

The biggest change is the zero-tax threshold being raised from ₹7 lakh to ₹12 lakh, ensuring significant savings for middle-income earners.

How This Will Benefit Taxpayers

- More Disposable Income: With no tax up to ₹12 lakh, families will have more money to spend and save.

- Boost to Economy: Increased household consumption and investment can drive economic growth.

- Simplified Tax System: The revised structure makes taxation more straightforward, reducing compliance burdens.

- Encouragement for the New Tax Regime: With lower rates and no tax up to ₹12 lakh, more taxpayers may opt for the new system over the old one.

Comparison: Old Tax Regime vs. New Tax Regime (Post Budget 2025)

| Income (₹) | Old Regime (With Deductions & Exemptions) | New Regime (Budget 2025) |

|---|---|---|

| 7 lakh | No Tax (after exemptions) | No Tax |

| 10 lakh | ₹52,500 (after deductions) | No Tax |

| 12 lakh | ₹82,500 (after deductions) | No Tax |

| 15 lakh | ₹1,17,000 (after deductions) | ₹45,000 |

| 20 lakh | ₹2,62,500 (after deductions) | ₹1,00,000 |

The revised new tax regime now makes it more attractive for middle-income earners, as they can avoid complex deductions while paying lower taxes overall.

Who Benefits the Most?

- Salaried Employees & Middle-Class Families – Increased tax exemption means more take-home income.

- Self-Employed Professionals & Small Business Owners – With the new tax regime set as default, lower rates will reduce the overall tax burden.

- Young Professionals & First-Time Taxpayers – Simple and lower tax rates make compliance easier.

Final Thoughts

The Budget 2025 tax reforms bring a massive relief to the middle class, allowing for more savings and investments. By raising the zero-tax limit to ₹12 lakh, the government has taken a big step toward reducing financial stress on taxpayers and boosting economic growth.

While the old tax regime remains an option, the new structure with lower rates and a higher exemption limit might encourage more taxpayers to switch to the new regime.

With household consumption and investment expected to rise, these tax changes could play a crucial role in India’s economic growth in the coming years.